August 11, 2025

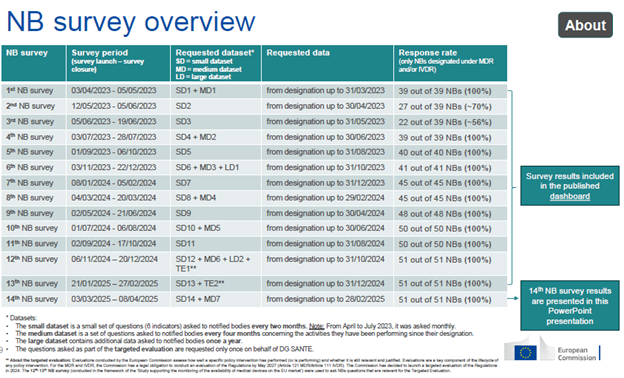

The European Commission (EC) recently updated its Monitoring the Availability of Medical Devices and In Vitro Diagnostic Medical Devices on the EU database, incorporating results from the 14th Notified Body (NB) survey (Q2 2025) and data collected earlier this year. Compiled by Gesundheit Österreich GmbH (Austrian National Public Health Institute) in collaboration with Areté and Civic Consulting, the dashboard tracks certification progress under the Medical Device Regulation (MDR) and In Vitro Diagnostics Regulation (IVDR).

We first covered the launch of the dashboard and shared initial findings in 2024. With 100% participation of designated NBs in the latest survey, the new figures offer a current view of application volumes, issued certificates and persistent bottlenecks that could affect device availability in the EU.

Figure 1: Updated NB survey on certifications and applications, EC.

From application to certification

While over 28,500 applications have been submitted for MDR certification, fewer than 18,500 written agreements are in place, each of which can cover multiple devices. Under the previous Medical Devices Directive 93/42/EEC (MDD) and Active Implantable Medical Devices Directive 90/385/EEC (AIMDD), about 21,376 valid product certificates had been issued. Because the MDR requires NB involvement for more device types, this lower volume suggests that some legacy devices have been discontinued; otherwise, application and agreement numbers would likely be higher by now.

The number of MDR Quality Management System (QMS) certificates grew from 4,301 in Q4 2024 to 4,500 in Q1 2025. MDR product certificates rose by 318 over the same period. Written MDR agreements also saw a slight uptick compared to December 2025, when the EC announced it was working on targeted revisions to the regulations.

For the IVDR, written applications have increased to 2,532, with fewer than half resulting in signed agreements (1,195). New QMS certificates for in vitro diagnostic (IVD) manufacturers now total 408, and new product certificates, issued for the first time, have reached 678. Overall, IVDR-issued certificates (QMS and product) increased by 17% from Q4 2024 to Q1 2025. While this growth is encouraging, the numbers remain low given that about 90% of previously self-certified IVD manufacturers under the In Vitro Diagnostic Devices Directive (IVDD) require NB involvement under the IVDR. Manufacturers with legacy IVDs that are upclassified to Class A sterile and Class B or Class C still have until May 2027 and May 2026, respectively, to submit applications, suggesting application rates will likely rise further in the coming years.

A persistent challenge is the shortage of European Reference Laboratories (EURLs) with the necessary scope. This is reflected in the proportion of Class D certificates issued outside EURL oversight, which currently stands at 79%.

For both MDR and IVDR manufacturers, the average time from application to signed agreement is about two months, a timeline IVD manufacturers should factor in to avoid a gap between old and new certificates. Across both regulations, the leading cause of rejected submissions remains incomplete forms or missing information, with most IVD manufacturers submitting incomplete applications.

Devices without a medical intended purpose

Applications for MDR certification of Annex XVI devices, products without a medical intended purpose, continue to rise slowly. However, to date, no applications have been submitted for Annex XVI, group 6 devices: “Equipment intended for brain stimulation that apply electrical currents or magnetic or electromagnetic fields that penetrate the cranium to modify neuronal activity in the brain.“ This absence may indicate a slowdown in innovation or availability for this category, potentially linked to MDR requirements.

Similarly, no certificates have been issued for single-use devices and their reprocessing under Article 17 MDR, despite 19 NBs holding this code within their scope.

Looking ahead

The total number of MDR and IVDR QMS and product certificates has now reached 25,034. Yet concerns remain over potential shortages caused by discontinued devices. To help prevent delays, manufacturers can focus on preparing complete, accurate applications. Incomplete submissions remain the leading cause of rejection, which extends the time needed to secure a signed NB agreement and may affect transitional timelines for legacy IVDs.

Request more information from our specialists

Thanks for your interest in our products and services. Let's collect some information so we can connect you with the right person.